Phased Liberalisation of Insurance Industry in Malaysia

Background

For the past 30 years, the premiums which insurance companies can charge consumers have been regulated by a tariff structure.

For motor insurance, this has resulted in a growing gap between premiums collected and claims paid out by the insurers. This has led to the Motor Third Party business becoming unsustainable.

To ensure that motor insurance cover continue to be made available and accessible to motorists, The New Motor Cover Framework (the Framework) was implemented in 2012 and saw four rounds of gradual upward adjustments from 2012 to 2015. The Framework also paves the way for phased liberalization of Motor Tariff in 2016. On the other hand, the Fire Tariff was revised three times from 1992 to 2000.

On March 2016, Bank Negara Malaysia (BNM) had announced the Phased Liberalisation of the Motor and Fire Tariffs before transitioning to a fully liberalized market. Motor and Fire Insurance are compulsory insurance protection in Malaysia, accounting for approximately 69% of the total general insurance and takaful market in 2019.

First Phase of the Liberalisation of Motor and Fire Tariff

Motor Insurance

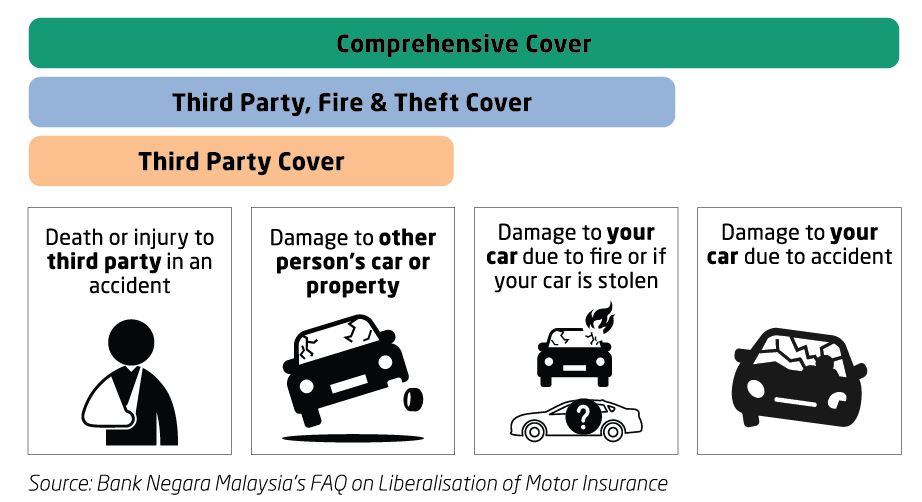

The first phase of liberalization was introduced on 1 July 2016. During this initial phase, insurers and takaful operators were given the flexibility to offer new motor products and add-on covers that were not defined under the existing tariff.

From 1 July 2017 onwards, premium rates for Motor Comprehensive; and Motor Third Party Fire and Theft products will be liberalised where premium pricing will be determined by individual insurers.

Among the motor insurance, only the Third Party policy will still be subjected to Tariffs with gradual adjustments. This is because there is a huge pricing gap relative to its risk. Based on a recent study, the total premiums collected annually on Motor Third Party products were approximately RM520 million, while incurred claims and expenses have increased to almost RM680 million. This means that for every ringgit of premium received for a Motor Third Party product, insurers and takaful operators paid out an average of RM1.30 in claims and related costs. Given the sizeable pricing gap relative to risk, an immediate deregulation of rates is likely to result in steep premium increases and thus, affecting large numbers of consumers.

Under the liberalised environment, more risk factors will be taken into account in determining premiums. Other than the sum insured, cubic capacity of the vehicle engine, age of vehicle and age of driver, premiums may be driven by other factors. These factors could be safety and security features of the vehicle, duration that the vehicle is on the road, geographical location of the vehicle (in areas with higher incidents of theft) and traffic offences on record. These factors will define the risk profile group of the policyholder which will determine the premium.

As different insurers and takaful operators have different ways of defining the risk profile group, the price of a motor policy would differ from one insurer to another.

The progress of liberalisation will be reviewed in 2019 with an assessment of the impact on consumers and industry before full liberalisation takes place.

Fire Insurance

To allow insurers time to rebalance their portfolios gradually, premium rates for Fire class will continue to be regulated under the tariff with gradual downward adjustments until a review is made in 2019.

On August 2019, BNM had extended the timeline for the detariffication of fire insurance to 2020 at the earliest after meeting with industry players to ensure that all stakeholders are ready for the liberalised environment.

Impact to Insurer/Takaful Operator

1. The liberalisation of insurance could lead to increased competition and pressure on underwriting profitability.

2. Competition will encourage insurers to innovate and offer a wider range of motor and fire products to cater for different consumer needs and preferences.

3. The new liberalised structure of the Malaysian general insurance market has proved to be an attractive proposition to foreign insurance companies, particularly those with established, mature businesses in other markets. With liberalisation, a number of these insurers have entered the Malaysian market to compete with existing insurers and have subsequently increased the level of competition.

4. Well-resourced insurance players with robust risk-based pricing model will have an advantage to register better underwriting profit and compete in a dynamic market.

5. Local insurers with fewer resources who are unable to compete in a detariffed environment have started merging with larger players, leading to an overall consolidation of the market.

Impact to Consumer

1. Consumers will have the freedom to shop around for the best prices based on their individual insurance needs.

2. Vehicle owner who has lower risk profile is able to enjoy lower premium charge.

Source:

1. Bank Negara Malaysia

2. PIAM website

Comments

Post a Comment