RCECAP (9296), a hidden GEM in Bursa

While I was reading my investment mentor, 第一天's blog, I have discovered an excellent company which is trading far below its intrinsic value! You can guess by looking at the picture that I posted -- in fact it's written on it. Ok, let me introduce to you the next hidden gem in Bursa, RCE Capital Berhad (RCECAP)!

Business Model

RCECAP is providing personal loans financing predominantly to civil servants. The difference between RCECAP and bank is, RCECAP's source of fund is from borrowing (Term Loans, Sukuk, Revolving Credit, Banker's acceptance) instead of deposit from customer. It makes profit from the spread between interest income from customer and interest expense paid for the borrowing.

It should be emphasized that RCECAP implementing direct salary deduction via Accountant General's Department of Malaysia and Biro Perkhidmatan Angkasa. This is an effective way to minimize default rate and thus improvement in profit margin.

Its another competitive advantage lies in fast loan processing turnaround time of 48 hours.

Business Segment

The Group has 3 main businesses:

1. Consumer Financing

Subsidiary: RCE Marketing Sdn Bhd and its subsidiaries

This is the main business of RCECAP, which I have explained the business in business model. It constitutes approximately 90% of revenue to the Group.

2. Processing and Administration of Payroll Collection

Subsidiary: EXP Payment Sdn Bhd

This segment is deemed as supporting department for consumer financing business. It provides collection services to payroll deductions of government departments under the purview of Accountant General.

3. Commercial Financing

Subsidiary: RCE Factoring Sdn Bhd

It offers commercial financing to SME via factoring and confirming facilities. Although commercial financing is not the significant contributor for RCECAP's revenue (less than 10%), I would like to explain further about factoring and confirming for learning purpose:

Factoring is where RCECAP buy account receivable at a discount from a company, to provide quick cash for the company. RCECAP will profit from the spread between purchase price and amount collected.

Confirming (also called as reverse factoring) is where RCECAP pay its client's invoice to supplier, at a discount, to accelerate rate in payment. For instance, if the invoice amount is RM100, RCECAP may pay its client's supplier RM90, and collect RM100 fully from its client. RCECAP will profit from the spread of RM10.

It should also be noted that confirming is a funding solution started by ordering party (buyer/RCECAP's client) to help its supplier finance their receivable easily.

The difference between factoring and confirming is, factoring provides funding solution to customer, confirming provides solution to supplier.

---------------------------------------------------------------------------------------------------------------

Financial Data

After discussing RCECAP's operations, I would prefer to turn immediately to its fiscal data.

Its revenue is growing in a very fast pace since with a 5-year CAGR of 16% and 26% on revenue and pre-tax profit. Besides, its pre-tax margin is maintain at a very high level and it's improving consistently every year! RCECAP is one of a handful company that has such stable earnings outlook.

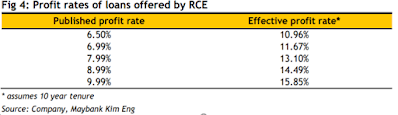

The tables below show the rate of interest income and expense of RCECAP:

Interest Income

Source: Maybank's Research Report

Average effective profit rate is 13.21%.

Income Expense

Source: Maybank Research Report

As 72% of RCECAP's borrowing is contributed by Sukuk. Average profit rate for sukuk (cost of fund) is 5.19%.

Profit Spread

With 13.21% of interest income, and 5.19% of cost of fund, the spread earned by RCECAP is 8.02%, which come out with gross profit margin of 60%! (8.02/13.21)

EPS and ROE

RCECAP's ROE remains at a higher level (13% to 18%), which indicates it is efficient in utilizing its equity capital.

It's worth noting that RCECAP has undertaken 4:1 share consolidation and capital repayment, which substantially reduce the number of outstanding shares. That's one of the main reason for sudden surge of EPS from 3.08 (2016) to 23.92 (2018). After the share consolidation, RCECAP's EPS is growing at 9% per year.

Dividend

Its dividend is growing every year and its current yield (6%) is higher than 2% + of FD rate. It's an attractive asset for dividend investor. From 2019 onwards, RCECAP will declare dividends between the range of 20% to 40% of profit after tax. Which means the dividend will increase if its profit is improving every year!

---------------------------------------------------------------------------------------------------------------

Recent News

1. Shariah Compliant

RCECAP has put its effort to be qualified as Shariah-compliant stock, and it's expected to fulfill the requirement by end of this quarter. However, it's compulsory to submit full year audited annual report in order to apply for Shariah qualification. As RCECAP financial year ended is on 31 March, the assessment is expected to conduct on November 2021.

Once RCECAP has become Shariah compliant stock, it is expected that Shariah-compliant fund or company will be attracted by excellent fundamental and valuation of RCECAP. This may further drive RCECAP's stock price.

2. Covid-10 Pandemic

As RCECAP disburses 100% of its personal financing to civil servants whose salaries have been relatively unaffected by the Covid-19 pandemic. Its main collection agent, ANGKASA, has also been operating as usual.

Besides, RCECAP is a non-bank financial institution, hence it's not required to offer moratoriums to its customer. But, it allowed less than 1% of its gross financing to undergo moratorium.

Thus, RCECAP is not suffering liquidity issues and can freely disburse financing.

---------------------------------------------------------------------------------------------------------------

Summary

It's rarely to find such fast growing company, strong business model and excellent fundamental company in Bursa Malaysia recently. It's important to invest in a fundamentally good company to reduce the possibility of making investment losses, however, price matters. Hence, I will do a valuation analysis for RCECAP in my next article, to find the fair price for it.

Comments

Post a Comment